Are you interested in using an Avon spreadsheet for taxes, but don’t know where to start getting organized? I’m here to help!

Below, I’ve outlined the steps I follow to keep track of my Avon finances throughout the year – plus a free template spreadsheet for you to use. Let’s dive in!

Step #1

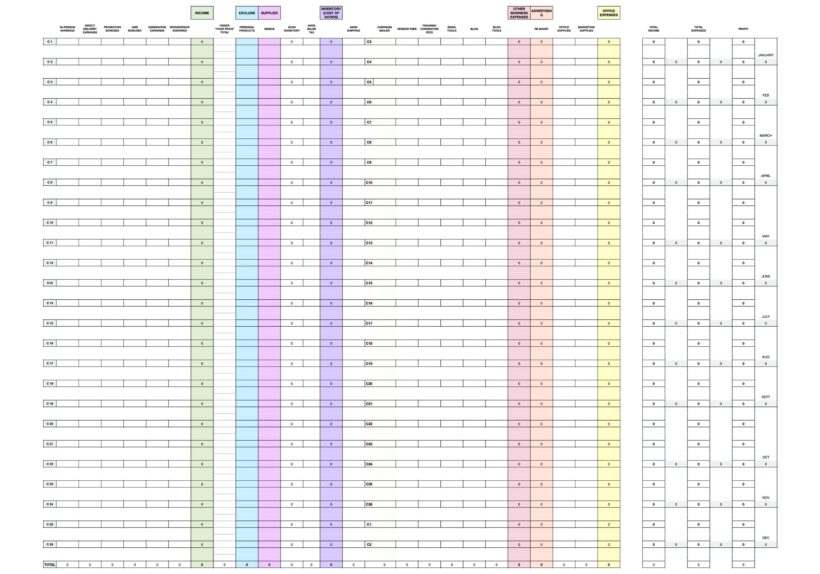

DOWNLOAD AND CUSTOMIZE THE SPREADSHEET

I’d like to share with you the spreadsheet I’ve created and updated over the past few years to keep track of my Avon expenses and income. Once you’ve downloaded the file, you can easily add and subtract columns based on how you run your Avon business.

DISCLAIMER: I am not an accountant and am not qualified to give tax advice. However, this spreadsheet has worked pretty well for me, and I’ve adjusted it over time to match the categories/entries in H&R Block’s online tax preparation tool.

NEW AND IMPROVED VERSION ADDED JAN 2024!

APPLE NUMBERS VERSION

EXCEL VERSION

Please note that one item you will find missing from this spreadsheet is gas mileage and/or vehicle expenses. I personally market my Avon business to sell online, and so I don’t have experience driving to make deliveries. I recommend consulting a tax professional or professional-run resource for more information about mileage and vehicle deductions.

Step #2

FIND ALL THE RECEIPTS AND INVOICES YOU NEED

The next step is to make sure you know where all the relevant pages live within the Avon website so that you can easily check them throughout the year.

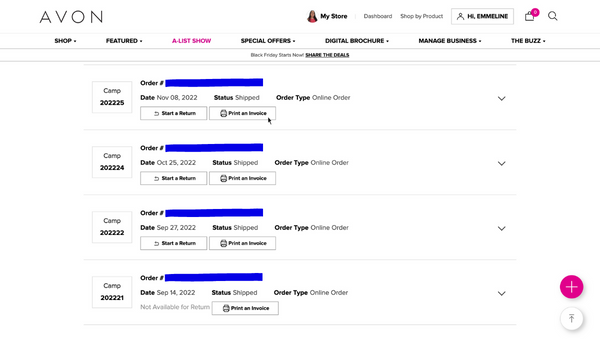

➤ Avon order invoices

To find the invoices for orders that you place in the Avon website, follow the tabs “Manage Orders” → “Order History & Returns”. From the orders page, scroll down to find the specific order you want, and click the “Print an Invoice” button to view it.

➤ Direct Delivery Earnings

To find your earnings for direct delivery orders placed on your e-store, follow the tabs “Manage Orders” → “Order History”. Here, you can filter the orders by date(s), by campaign, and/or by order type to find what you’re looking for. You may have to do a little math to figure out your commission amount from each customer’s invoice.

Once you’ve done this, I also like to cross-check the commission amounts from my account balance history. The “Account Balance” tab is underneath where your name is located in the top right corner of the homepage.

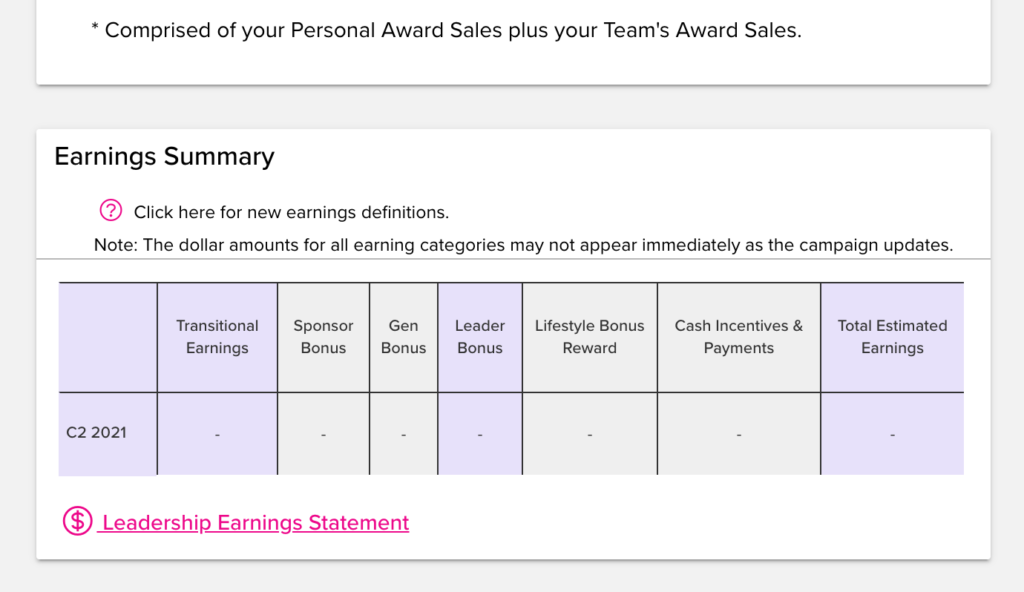

➤ Leadership Earnings

If you have your own team, you will need to keep track of your leadership earnings. Follow the tabs “My Team” → “Leadership Dashboard” and then click on “Leadership Earnings Statement” hyperlink under the “Earnings Summary” heading.

➤ Third-party receipts

If you purchase other items for your business such as office supplies, business cards, etc., make sure to find out how to find and save the receipts for each purchase.

How to find your avon rep account number

How to create an exclusive coupon code for your Avon customers

How to process a return as an avon representative

7 FAQ’s about Avon customer payments (for reps!)

How to mail Avon brochures to your Avon customers

How to find the current Avon policies and procedures document for reps

Step #3

CREATE A SYSTEM FOR SAVING YOUR RECEIPTS AND INVOICES

The best way to stay organized is to save your receipts and earnings information throughout the year.

I personally keep my third party receipts electronically in a specific folder on my computer, while I transfer the other information straight from my Avon back office to my spreadsheet. You might prefer to print things out and organize them into physical folders. Whatever you choose, be consistent!

Step #4

FILL OUT YOUR SPREADSHEET THROUGHOUT THE YEAR

This step is pretty self explanatory!

I try to update my spreadsheet once every campaign to stay on top of things, but your schedule is totally up to you.

Step #5

FILE YOUR TAXES!

If you’ve followed steps 1-4, you’ll be all ready come tax season! Since we are independent contractors with Avon, you’ll file that income as a self-employed individual.

The best option, of course, is to hire a tax professional to help prepare and file your taxes using the information you’ve compiled.

If you prefer to prepare your own taxes, you can visit the IRS’s official Free File page to see if you qualify to file your taxes for free using professional online tools. If you make too much income to qualify, you can still use the tools available online – however, it will cost you a bit of money.

And that’s it! Those are the steps I follow to keep track of Avon expenses using a spreadsheet for taxes. Good luck!

If you need more help with Avon-related topics, make sure to check out the other tutorials on the blog. If you don’t see your question answered yet, feel free to ask in the comments below!

Love the spreadsheet. Thank you for it. Question about products purchased for personal use….do I add the amount of sales tax Avon has charged me for the products. I know it’s probably a dumb question. I just want to make sure I’m doing everything by the book!

Hi Donna, sorry for the delayed response!

For that particular question, you should ask a tax professional. I’m not qualified to give specific tax advice like that – only general organization tips.